Ask anybody outside the US what NASCAR is, bar a few, most would give you a blank questioning stare. The premier motorsport event followed worldwide is the F1 (Formula 1).

F1 held its first Grand Prix in the US in 2022 at the Miami International Autodrome under a ten-year contract. But what vaulted the F1 into the collective consciousness of the American motorsport fan was the Las Vegas Grand Prix held on November 18, 2023. The buzz around that event on social media was perceptible. Like soccer (football as it is known worldwide; outside the US), F1 has started to make great inroads and strides in the US market.

Las Vegas Grand Prix

Las Vegas is the county seat of Clark County. Recently, Clark County released a debriefing on the LVGP (Las Vegas Grand Prix). Here is the economic impact of the LVGP according to the report:

Economic Impacts Sourced to F1 and the 2023 LVGP Approached $1.5 Billion

Total Economic Impact of Las Vegas Grand Prix Visitor Spending was $884 Million

Grand Prix Visitors Spent 3.6 Times the Typical Traveler

Stayed 4.1 Nights and Spent More than $4,100 Per Trip (Does Not Include Ticket Price)

Net Visitor Spending Reached $501 Million

Ripple Effect of Visitor Spending Reached $884 Million of Impact

Millions of Dollars in Infrastructure and Event Hosting

Direct Economic Impact (Excluding Land Acquisition Costs and Out-of-Market Purchases) Totaled $329 Million

Ripple Effect of that Spending Translated into $587 Million of Local Economic Impact (Indirect and Induced Spending)

LVGP spent nearly $88 million on public infrastructure

Wages to Local Workers Reached $52 Million in the 1st Full Year

Job Impacts:

Development of Race-Related Infrastructure, including the Pit Building, Supported Nearly 2,200 Jobs

Event Operations and Visitor Spending Activity Supported Nearly 5,100 Additional Positions

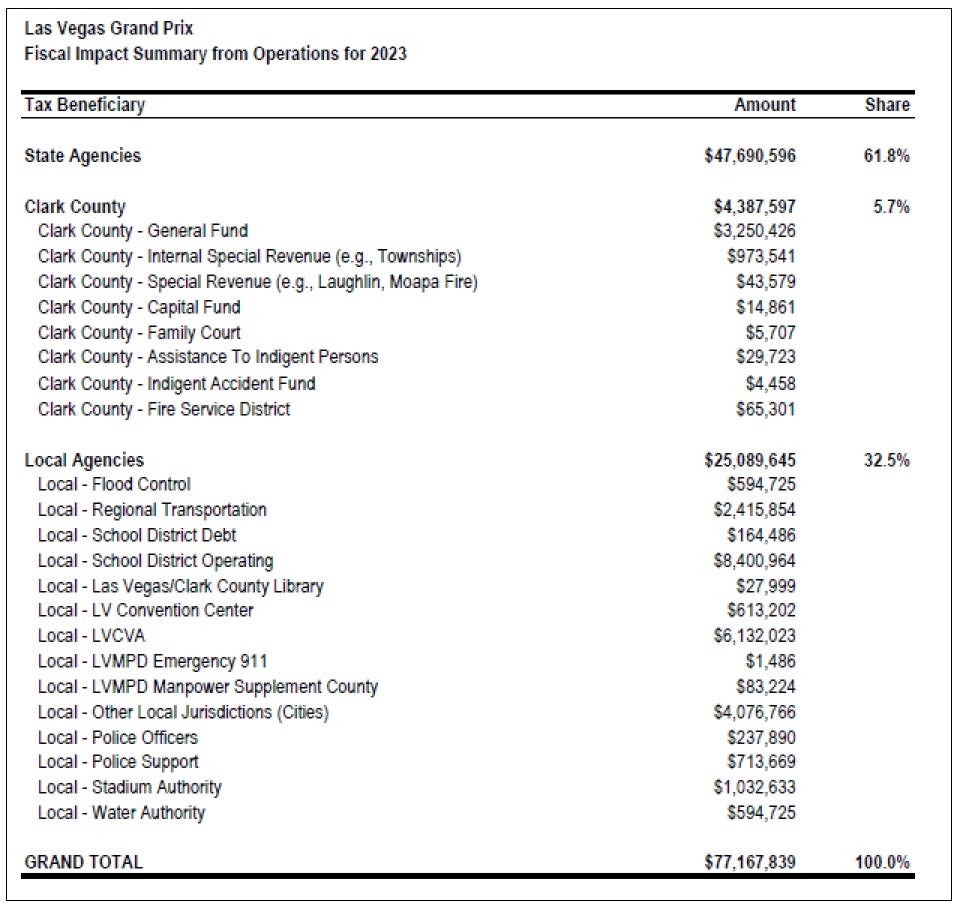

2023 LVGP Generated More State and Local Taxes than Any Event in Las Vegas History:

$77 Million in Tax Revenues for State and Local Governments

Includes Live Entertainment Taxes, Room Taxes, Sales and Use Taxes, Gaming-Related Taxes, and Property Taxes

LVGP Fiscal Impact Summary

Given the success of the 2023 LVGP, it would not be far-fetched to assume that Clark County would bend over backward to ensure the F1 returns to Las Vegas and stays there. Stay it will, as there is a 10-year contract in place.

Can Retail Investors Get a Piece of the Action?

Fortunately, unequivocally, yes. Liberty Media Corporation, which owns 100% of F1, has floated “tracking stocks” of its Formula One Group subsidiary. These tracking stocks give direct exposure to the Formula One Group and its performance without being encumbered by having to gain exposure via the parent holding company.

The following are the listed tracking stocks of the Formula One Group:

Series A Liberty Formula One Common Stock - FWONA

Series B Liberty Formula One Common Stock - FWONB

Series C Liberty Formula One Common Stock - FWONK

The Liberty Formula One common stock is intended to track and reflect the separate economic performance of the businesses, assets, and liabilities attributed to the Formula One Group, which, as of December 31, 2023, include Liberty’s interest in Formula 1, cash and Liberty’s 2.25% Convertible Senior Notes due 2027.

FWONA and FWONK are listed on Nasdaq. Meanwhile, FWONB is on the OTCBB. FWONA has voting rights of one vote per share; FWONB has voting rights of 10 votes per share; and FWONK has no voting rights.

FWONK is the most liquid, having an average daily volume of 1,115,970 shares. FWONA has an average daily volume of 95,891. FWONB is illiquid and almost 97% is held by insiders.

On April 5, 2024, FWONA closed at 60.84 and FWONK closed at 68.49. Inquiring minds want to know why the nonvoting stock is trading at a 12.6% premium to the voting stock. I haven’t been able to figure it out, but if one of you does, please post the rationale in the comments.

New Acquisitions

Formula One Group has this year completed the following acquisitions or principally agreed to acquire one of the following:

Quint (Completed) - an industry-leading provider of official ticket and hospitality packages.

MotoGP (In Progress) - Grand Prix Motorcycle Racing League.

Quint’s financial performance will start reflecting from Q1 2024. Meanwhile, MotoGP’s financial performance will start reflecting post-completion of the acquisition.

F1 Business Highlights

Formula 1 holds exclusive commercial rights to the FIA Formula One World Championship, an annual, approximately nine-month-long, motor race-based competition in which teams compete for the Constructors’ Championship and drivers compete for the Drivers’ Championship. Formula 1 racing began in 1950 and is the world’s most prestigious motor racing competition, as well as the world’s most popular annual sporting series: The FIA Formula One World Championship™ runs from March to November and spans across 20 countries and five continents.

Fan Experiences and Other Ventures

F1 has a razor-sharp focus on enhancing fan experience, and it has to have that to succeed. Apart from providing a plethora of options for regular fans to engage with the F1, they also provide VIP experiences via their “Paddock Club” and “Quint” offerings. Fan engagement and satisfaction are perceptible in the numbers.

Paddock Club

The Paddock Club offers the F1 experience close up and personalized. Here is how F1 highlights the experience:

Where you’re not just trackside, you’re inside. With a view of every pit stop and start line surge, from just above the pit lane. And experiences that take you beyond behind the scenes. With VIP hospitality from around the world. And around the corner. This is F1 up close and personalised.

From your seat above the team garages, you’ll be right in sight of the action. See the heat rise as the cars line up for lights out. Watch every pit stop and start line surge.

Fully immersive indulgence with the finest food and drink hospitality. Exclusive experiences that get you closer to F1 than ever. Paddock Club is the only place you’ll have access to all this and more.

F1 Arcade

A thrilling F1® racing experience designed to make you feel like a champion. F1 Arcade brings all the excitement, glamour and thrills of Formula 1® with our bespoke full-motion racing simulators, incredible food & cocktail menus and an electric atmosphere creating the perfect social gaming experience.

- Formula One Group

F1 Arcade achievements:

300,000+ visitors in 1st year at the London venue.

Birmingham, UK venue opened in November 2023.

20+ permanent venues to be opened in the US over the next five years.

Boston & Washington venues are expected to open in 2024.

F1 Exhibitions

These are multi-year global traveling exhibitions allowing fans to get up close with the history and technology of F1. 175,000+ fans visited the exhibition in Madrid in the 1st year since opening. The Vienna exhibition opened in February 2024. More such exhibitions to engage further with fans are expected over the next few years.

F1 Academy

In 2023, the Formula One Group launched the F1 Academy. This platform is to inspire women, increase grassroots participation, and increase the talent pool of young girls and women entering the F1 both on and off the track. In 2024, there will be 21 races across 7 F1 race weekends.

F1 Academy is more than just a competition it is a movement. We want to inspire Women around the world to follow their dreams and realize that with talent, passion, and determination, there is no limit to what they can achieve.

Susie Wolff - Managing Director, F1 Academy

Quint

Quint is the industry-leading provider of official ticket and hospitality packages to many of the world's most prominent sports and entertainment events. Quint’s innovative programs enable those properties to expand fan experiences and corporate client entertainment opportunities in a way that reflects the quality and prestige of those brands.

Quint has a portfolio of 15+ official property partnerships servicing over 90 events including Formula 1®, NBA, Kentucky Derby®, MotoGP™, Chicago Bears, Green Bay Packers, The Open Championship, NASCAR, Breeders Cup, Belmont Stakes, and the NHL®.

The Quint acquisition was completed in 2023 and is immediately value accretive. Exact financial performance numbers will be available in detail when Q1 2024 results are released. Here is the transaction overview:

Valued at $313m

Funded with cash on hand from Formula One Group

Rationale:

High growth asset with attractive cash conversion

Strengthen position in sports & entertainment

Leverage Liberty relationships across sports and live events to expand Quint partners

Enhance Quint partnership opportunities with F1

MotoGP

MotoGP is the Formula 1 of motorcycle racing. MotoGP, also known as Grand Prix Motorcycle Racing, is the highest class of motorcycle road racing events held on road circuits sanctioned by the Fédération Internationale de Motocyclisme (FIM). Grand Prix motorcycles are purpose-built racing machines that are unavailable for purchase by the general public and unable to be ridden legally on public roads.

The acquisition of MotoGP is expected to be completed by the end of 2024. Here are the transaction highlights:

Liberty announces agreement to acquire Dorna, exclusive commercial rights holder to the MotoGP World Championship on April 1, 2024

Attributed to Formula One Group tracking stock

Transaction equates to €4.2b Enterprise Value / €3.5b Equity Value

Liberty to own 86% with management retaining 14% pro forma ownership in MotoGP

Equity consideration expected to be comprised of approximately:

65% cash

Funded with a mix of cash and debt, subject to market conditions

21% Series C Liberty Formula One common stock (FWONK)

Determined based on 20-day volume weighted average price (“VWAP”) prior to close

Liberty retains option to deliver additional cash in lieu of FWONK equity

14% retained management equity

Existing debt balance at MotoGP expected to remain in place

Targeting close by year-end, subject to the receipt of regulatory approvals

MotoGP management team to remain in place post-close with Carmelo Ezpeleta as CEO

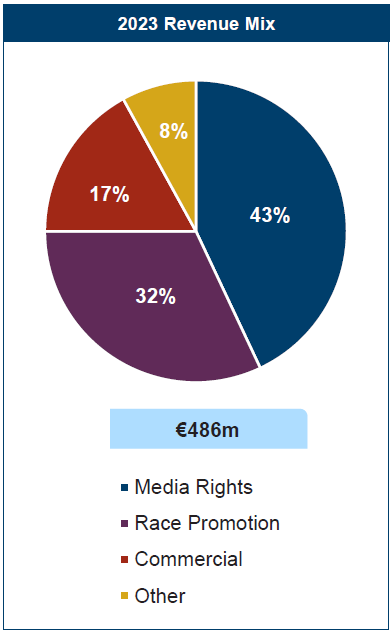

MotoGP Revenue Mix

Approximately 80% of revenue is under medium- and long-term contracts that typically include annual escalators. MotoGP had a revenue of €486m in 2023 and here is the revenue mix:

MotoGP Profitability and Cash Flow

MotoGP has high Adjusted EBITDA margins with minimal capital intensity resulting in significant free cash flow generation.

F1 FY2023 Revenues and Cost of Revenue

Formula 1’s operating results were as follows:

Primary Formula 1 revenue is derived from the commercial exploitation and development of the World Championship through a combination of:

Race Promotion Fees

earned from granting the rights to host

Stage and promote each Event on the World Championship calendar

fees from certain race promoters to license additional commercial rights from Formula 1 to secure Formula 2 and Formula 3 races at their events

technical service fees from promoters to support the origination of program footage

ticketing revenue from Formula 1’s direct promotion of the Las Vegas Grand Prix

Media Rights Fees

earned from licensing the right to broadcast events and Formula 2 and Formula 3 races on television and other platforms

F1 TV subscriptions and other related services

the origination of program footage

footage from Formula 1’s archives and the licensing of radio broadcasts and other ancillary media rights

Sponsorship Fees

earned from the sale of World Championship and event-related advertising and sponsorship rights and the servicing of such rights

rights to advertise on Formula 1’s digital platforms

at non-Championship related events

Other Formula 1 revenue is generated from miscellaneous and ancillary sources primarily related to:

facilitating the shipment of cars and equipment to and from events outside of Europe

the sale of tickets to the Paddock Club at most Events

the sale of hospitality and experiences at the Las Vegas Grand Prix

the operation of Formula 2, Formula 3, and the new F1 Academy series

other licensing opportunities

various television production activities

other ancillary operations

The cost of Formula 1 revenue consists of:

team payments (largest cost; $1,215 million in 2023)

costs related to promoting, organizing, and delivering the Las Vegas Grand Prix

hospitality costs

costs incurred in the provision and sale of freight, travel, and logistical services

sponsorship and digital product sales commissions

circuit rights’ fees payable under various agreements with race promoters to acquire certain commercial rights at events

annual Federation Internationale de l’Automobile (“FIA”) regulatory fees

Formula 2 and Formula 3 cars, parts, and maintenance services

costs related to the new F1 Academy series

television production and post-production services

advertising production services

digital and social media activities

Valuation

Formula One Group has been in a steady investment mode over the last few years and comparing financial results to previous years becomes hard as one would have to add back some of the new growth to the previous years and make quite a lot of assumptions.

Currently, as per the metrics presented above, Formula One Group looks financially sound. How the MotoGP acquisition is finally consummated financially will play a big role in how Formula One Group’s balance sheet ends up and how much leverage gets built in.

I used one of Prof. Aswath Damodaran’s valuation spreadsheets (see references). It only requires me to make one assumption: what is the expected average operating income growth over the next 10 years? The rest is magic, all taken care of.

So, here are the current fair value per share for Formula One Group:

9% growth - $22

15% growth - $35

20% growth - $51

25% growth - $74

Apart from straight-up valuations, there are also the expected projections based on what Liberty Media can do with all the premiere properties it has accumulated under the Formula One Group and expectations of how well they can manage to unlock value in them.

Note: Formula One Group is domiciled in the UK and subject to UK corporate taxes, which are at 25% now.

Conclusion

I was impressed by how Liberty Media unlocked value in the Atlanta Braves and the beautiful transaction they did last year. They have also shown their management capabilities with SiriusXM and Live Nation.

I have been impressed by what they have said over the years about their philosophy and core beliefs. Here is a snapshot:

Pre-2016 - Liberty Investing in Premium Businesses and Exiting Traditional Media

Media Focus on Subscription Businesses

Exit Vulnerable Media

Seek Protected Niches Where We Can Be Market Leaders

Increase Emotional Engagement in Customer Experience

Think Global

2016 - Music Streaming Has Questionable Economics

2017 - The Power of Live: Commands Time and Wallet Share

2018 - Too Much Video Content, Too Many Platforms = Circular Firing Squad!

2019 - Audio: The Ear Has More Upside than the Eye

2020 - The Covid Accelerants

Digital Boomers

On-site is the New Offsite

Charles Schwab Meets Candy Crush

Dr. McDistance and more…

2021 - Post-Covid: You Only Unlock Once

2022 - Limbic System Connections Build Resilient Businesses

Personally, I am adding Formula One Group to my portfolio but it will not exceed 1% of the whole portfolio. I plan to add slowly and over the next two years. As usual, I just show an opportunity, what you do with this information is up to you.

References

Liberty Media Corporation 2023 10K (pdf)

Liberty Media Acquisition of MotoGP (pdf)

2023 Liberty Investor Day Presentation (pdf)

Valuation spreadsheets from Aswath Damodaran, Professor of Finance at the Stern School of Business at New York University. Here is the one I used (excel).

Clark County Debriefing on LVGP (pdf)