Combined Ratio

An awesome insurance company.

Note

This article was written on March 15, 2023. It is being reproduced apart from the last few lines upon permission from our owner. His father is in the ICU and has not been able to write recently.

Before diving into Palomar's (PLMR) in-depth analysis, we want to emphasize that this year's markets will be challenging, and we urge our readers to exercise caution when investing. In the case of PLMR, we advise adopting a "buy the dips" strategy and keeping it as a modest stake in the portfolio. Let's now examine what makes PLMR a fantastic asset for one's portfolio.

We favor insurance companies that can identify a market niche, have cutting-edge technology, reliable products that fill unmet needs, stable underwriting income, solid combined ratios, and most importantly, have a conservative investment philosophy. PLMR ticks all those boxes.

PLMR

In October 2013, PLMR, an insurance holding company, was initially incorporated in accordance with Cayman Islands legislation. In accordance with Section 388 of the Delaware General Company Law, PLMR completed domestication in March 2019 and became a Delaware company.

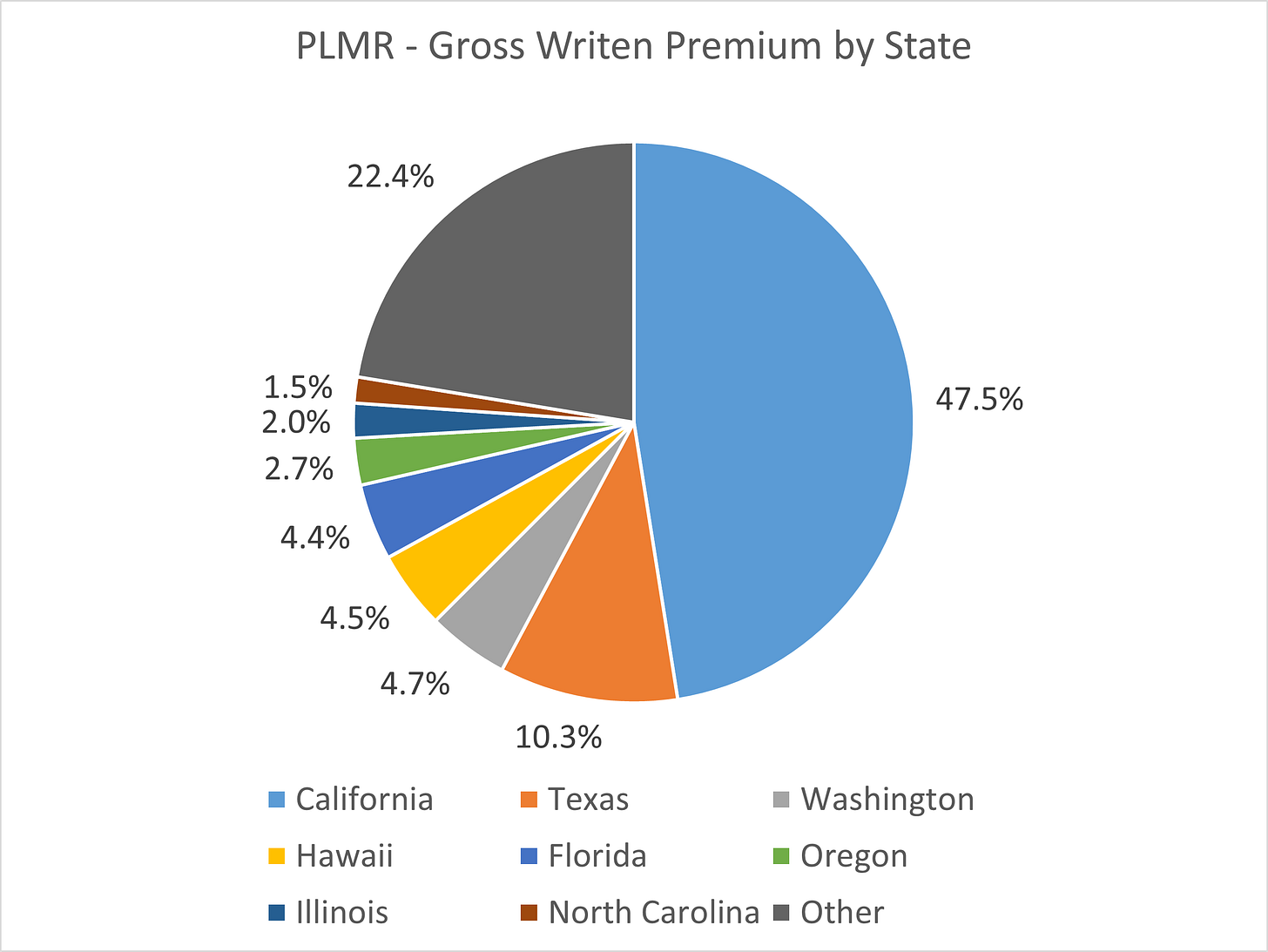

PSIC, the main operating subsidiary of PLMR, is an "admitted insurer" authorized to conduct business in 37 states as of December 31, 2022. PSIC is headquartered in the state of Oregon. PSIC was founded in February 2014.

An "admitted insurer" is completely backed by the state they are licensed in and the insurance cover provided by the insurer is completely backed by the state. A "non-admitted insurer" can write insurance that nobody else would underwrite but one would not have state backing if the insurer were to not meet its obligations.

A Bermuda-based reinsurance company called Palomar Specialty Reinsurance Company Bermuda Ltd. (abbreviated "PSRE"), which serves only PSIC and PESIC, was established by PLMR in August 2014.

Think of a reinsurer as an insurance company for insurance companies. Insurance companies pay a premium to the reinsurer to reduce the risk that they have taken. Essentially the reinsurer provides financial protection to insurance companies in case of losses incurred on underwritten policies.

In order to underwrite specialty insurance products on behalf of other insurance firms, PLMR established Prospect General Insurance Agency, Inc. in August 2015. This company is now known as Palomar Insurance Agency, Inc (PIA).

In December 2020, PLMR received permission to establish another subsidiary, PESIC, with Arizona residency and an Arizona license to write nationwide surplus lines (non-admitted insurance as described above) of business across all of their current lines of business.

Products

In their target areas, PLMR offers specialized personal and business insurance products.

To provide customers with more choices, PLMR developed an analytical framework to develop flexible products with novel coverages and pricing that, in their opinion, more accurately represent the underlying risk.

In 2014, PLMR first introduced residential and commercial earthquake products using this framework. Since then, they have extended their product lines to cover a variety of specialty risks across several U.S. regions. By entering markets that exhibited one or more of the following characteristics, PLMR has expanded the company.

Have loss characteristics, including limited attritional losses, similar to PLMR's initial earthquake product. Simply put, PLMR only wanted to enter markets where it could generate underwriting profits similar to its initial offering.

Can benefit from PLMR's technology platform, data analytics, and customer-centric products.

Allows PLMR to leverage their existing underwriting talent, reinsurance expertise, and/or distribution relationships.

PLMR provides the following products:

Residential Earthquake

Commercial Earthquake

Fronting

Inland Marine

Commercial All Risk

Hawaii Hurricane

Speciality Homeowners

Residential Flood

Casualty

Earthquake Specialization

One distinguishing aspect of PLMR's earthquake product offering is its pricing model. They can assess and correctly price exposures at the ZIP code or geocode level based on characteristics specific to the risk using data from industry-leading catastrophe models. For example, they believe competing earthquake insurance products in California are commonly based on broad territorial pricing zones that do not consider regional differences in soil types, and liquefaction potential and include little price differentiation between risks with varying proximity to known faults.

PLMR's ability to divide geographies into highly resolute grids, or ZIP codes, and price according to more detailed information relating to the exposure allows PLMR to obtain a more appropriate rate for the risk and often allows PLMR to offer rate relief, particularly in low-risk areas that historically have low earthquake insurance penetration.

Fronting

While fronting is a relatively new business for PLMR, it has gone on to become the largest contributor to its premium growth in the last few years.

To support the creation and administration of specific insurance programs, PLMR's Fronting division provides admitted and E&S (non-admitted) products to reinsurers, insurance companies, and managing general agents. For programs funded by reinsurance or alternative capital providers, or for other insurance companies that might not have the licensing, product suite, or rating to serve their desired markets, PLMR issues insurance policies. Furthermore, PLMR engages in fronting agreements with program managers that mandate the use of a widely licensed, highly rated carrier for business operations in specific states.

Marketing and Distribution

PLMR markets and distributes its products through a multi-channel, open-architecture distribution model which includes:

Retail Agents

Wholesale Brokers

Program Administrators

Carrier Partnerships

Technology

The integrated technology systems of PLMR serve as the company's backbone by allowing it to provide policyholders and producers with high-quality and prompt service, interact easily with reinsurers and partner carriers, and manage its operations more effectively and economically.

Being a newly established insurance company, PLMR has the advantage of having developed a proprietary operating platform that makes use of the vast experience of its management team and is free of burdensome legacy technology and procedures.

The systems of PLMR make PLMR's pricing models, quoting tools, policy management systems, and portfolio analytics databases more accessible to distribution partners and offer seamless integration between them.

Producers can directly access their retail and wholesale distributed products, such as "Residential Earthquake", "Commercial Earthquake", "Hawaii Hurricane", "Inland Marine", and "Residential Flood", thanks to PLMR's internally created PASS (Palomar Automated Submission System). Additionally, PASS acts as the access point for business written through direct personal lines partnerships as well as the administration system for specific policy data. Through the efficient use of predefined underwriting, PASS offers PLMR's production partners speed, optimization, and real-time transparency in underwriting and aggregate management.

Competition

American International Group, Inc.

Chubb Limited

State Farm Mutual Automobile Insurance Company

Zurich Insurance Group Ltd

Lloyd’s of London

California Earthquake Authority

National Flood Insurance Program

Underwriting and Risk Management

The starting point for any insurance company is to have a great product suite but they can't win without proper underwriting and risk management.

Underwriting

The underwriting team at PLMR combines thorough data analysis with seasoned underwriting methods to create a successful, reliable, and diverse book of business. The steps in PLMR's underwriting process include gathering enough underwriting data, categorizing and analyzing each individual risk exposure, determining how the risk will affect the company's current portfolio, and pricing the risk appropriately. The guiding principle of PLMR's underwriting is to "write what they know." This simple strategy enables its underwriters to concentrate on the business they comprehend and can process quickly without compromising diligence and attention to detail.

Traditional underwriting metrics, management expertise, and cutting-edge data analytics are used by PLMR to create its underwriting standards and pricing models for its property and casualty products. The actuarial team at PLMR works closely with its underwriters to calculate pricing and risk exposure. With the help of this analytical and underwriting framework, PLMR is able to correctly price higher-risk risks while providing rate relief in low-risk areas.

For the year ending December 31, 2022, personal lines policies accounted for about 37% of PLMR's total written premium. These policies are issued through automated underwriting. Distribution partners can quickly quote and bind accounts with lower limits using automated processing and the predefined underwriting guidelines provided by PLMR.

Due to the added complexity of property and casualty commercial lines risks and the difficulty of fully automating underwriting, PLMR combines thorough risk analysis, data gathering, and underwriting expertise to effectively assess individual risk and quote business.

Reinsurance

PLMR purchases a significant amount of reinsurance from third parties that they believe enhance their business by reducing their exposure to a potential catastrophe and attritional losses, limiting volatility in their underwriting performance, and providing them with greater visibility into their future earnings. Reinsurance entails giving another insurer, the reinsurer, a portion of the risk exposure on the policies they write in return for a premium.

Financials

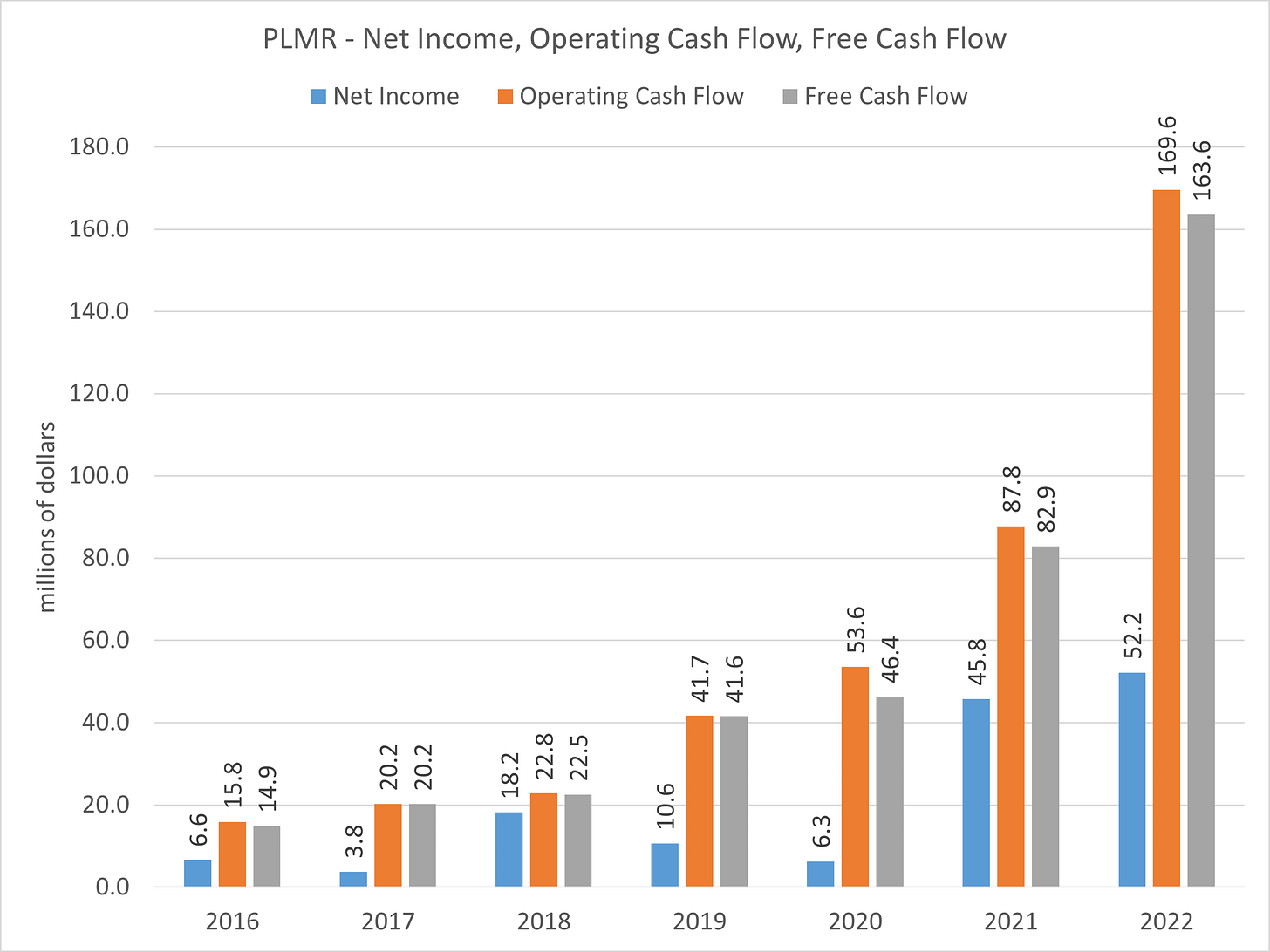

Even though PLMR was negatively impacted by the COVID pandemic, it has managed to recover and how. The growth in sales and net income speak for themselves.

For 2022, PLMR wrote $882 in premiums for policies but ceded $525 million for reinsurance, etc. associated with those policies and that has been reflected as per GAAP below.

Combined Ratio

All the above is great, but for an insurance company what matters most is the "combined ratio". Let's get the definitions out of the way first:

The loss ratio, expressed as a percentage, is the ratio of losses and loss adjustment expenses, to net earned premiums.

The expense ratio, expressed as a percentage, is the ratio of acquisition and other underwriting expenses, net of commission, and other income to net earned premiums.

The combined ratio is defined as the sum of the loss ratio and the expense ratio. A combined ratio under 100% generally indicates an underwriting profit. A combined ratio over 100% generally indicates an underwriting loss.

PLMR's combined ratio has been 80.4% and 80.0% in 2022 and 2021 respectively. This is stellar. How stellar? Most large insurance companies are barely able to stay around 98% and make most of their money from investing activities. You might have heard about Warren Buffet; he gets his investing cash from the stellar combined ratio of his insurance subsidiaries. That is how important it is.

On this front, PLMR is doing great and will have enough underwriting profits to drive future growth and generate shareholder returns.

PLMR's Investment Book

With what is going around with the regional banks in the US, it would be worth paying attention to the investment book of PLMR.

The projected fair value of PLMR's fixed maturities was $515.1 million as of December 31, 2022. According to PLMR, a 100-basis point rise in interest rates would result in a 3.7% drop in the estimated fair value of its fixed maturity portfolio, while a 100-basis point fall in rates would result in a 3.9% rise in that portfolio's estimated fair value.

Assuming the Fed hikes the Fed funds rate to 6% by year-end, one can, on a conservative basis, write down the fair value of PLMR's book by another $30 million. That would put their book underwater by $76 million as it is already underwater by $46 million. But unlike banks, they are not held to the whims and fancies of depositors, i.e., there is no chance of a bank run here.

In case PLMR's risk management fails and they are forced to sell some of the holdings, then it would have a material impact on earnings. This would put pressure on the stock, giving one a great opportunity to buy a fast-growing insurance company.

Also, one would need to keep an eye on the quarterly earnings as they are released to gauge the growth in earnings and whether PLMR is able to lap this fall in fair value due to rising interest rates. That is the reason we said to buy the stock on dips and over time and not in one go.

Apart from everything else, what stands out is the PEG ratio of 0.29 for a company that is growing revenues at 35% and its net income is also keeping pace. This is what one would term as growth available at a value.

Pulled this old one out of the bag. I gave PLMR to my friends in March 2023. This one is a banger. You don’t get a 79% combined ratio every day. Until next time. Have fun.

Disclosures: Here are our internal governance rules to ensure no conflict of interest. For companies we write about:

No existing position.

If we have an existing position, we exit and wait seven days before publishing.

Wait 30 days after publishing before initiating any new position.