Are TSLA, NVDA, and SMCI Cooking Books?

A look at two measures to detect fraud in financial accounts of a company.

This post will be short and tactical, unlike my previous ones.

A few of you follow me on X (formerly Twitter; my handle is “theOrcaFin”) and have already seen what I have been up to with TSLA, NVDA, and SMCI over the last few days after NVDA earnings came out. While I have shared enough actionable information there, I have withheld the whole process.

So, what is all the brouhaha about? Investing is not only being able to fundamentally evaluate a company and buy good companies at fair valuations, it is also being able to ensure that no financial shenanigans are going on. But how does a normal retail investor with no forensic accounting experience do that? Fortunately, a lot of work has been done historically to enable such investors.

In the late 1990s, Enron was the hottest stock on planet earth along with all the dot-com garbage. It could do no wrong. But there was this nondescript professor working on a financial fraud detection model at Kelley School of Business at Indiana University. Dr. Messod Daniel Beneish was building what would go on to be known as the Beneish M-Score.

As Enron was at the top of the world in 1998, a few industrious students at Columbia Business School applied the Beneish M-Score test on Enron. Enron failed the test and was flagged as an earnings manipulator. Wall Street ignored the warning. Enron’s stock went from $48 in 1998 to $90 in 2000. By 2001, it was bankrupt.

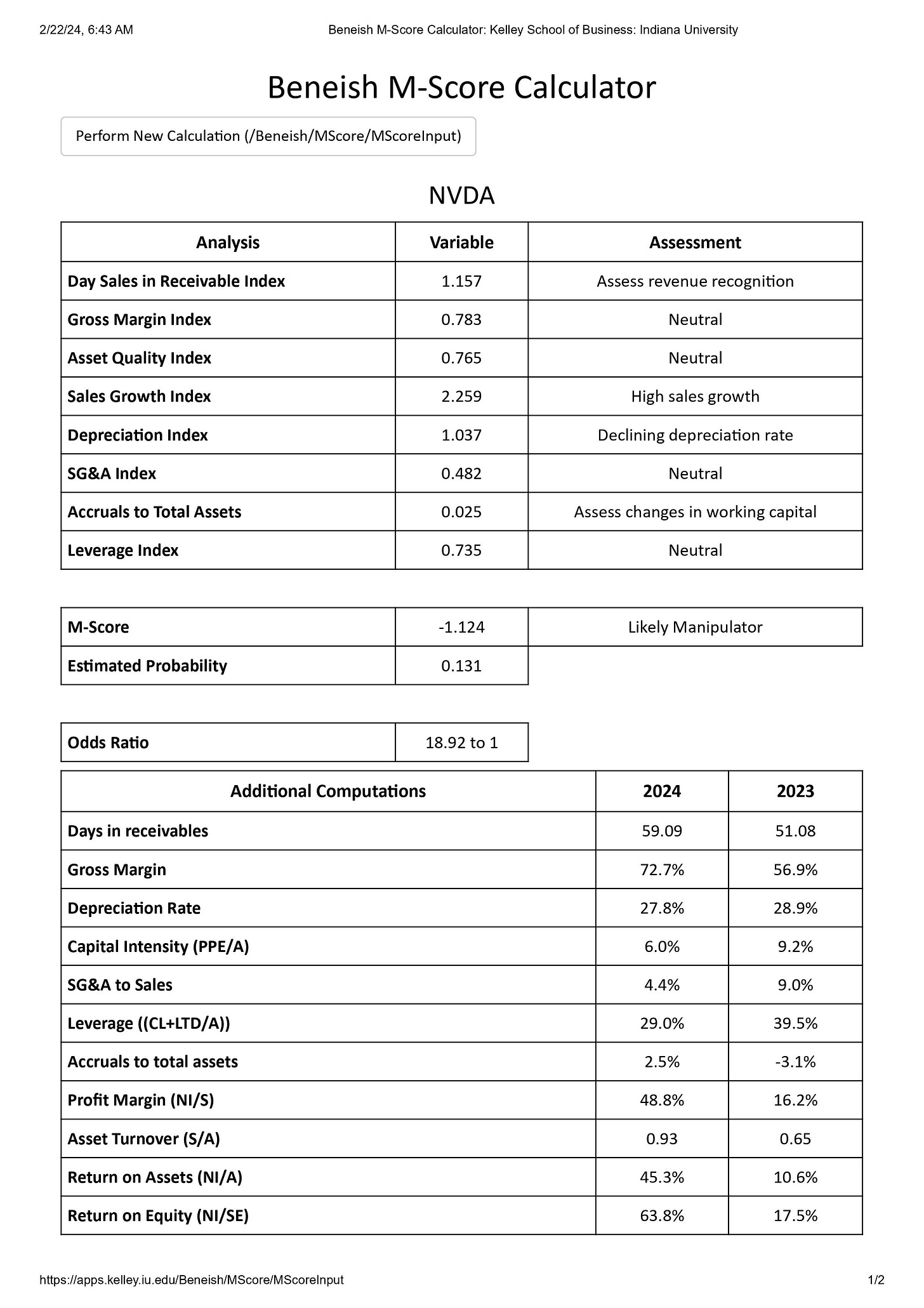

My antenna always goes up when a stock goes parabolic and the runup just doesn't quite jive with the basic fundamentals. So after NVDA released its earnings this week, I ran its numbers through the Beneish M-Score calculator. It was flagged as a “Likely Manipulator”. Let’s get the terminology out of the way first.

The M-Score gives three results:

No Manipulation - self-evident.

Possible Manipulator - early or middle stages of manipulating books.

Likely Manipulator - full-on manipulation of books.

So, here is the result of the test for NVDA.

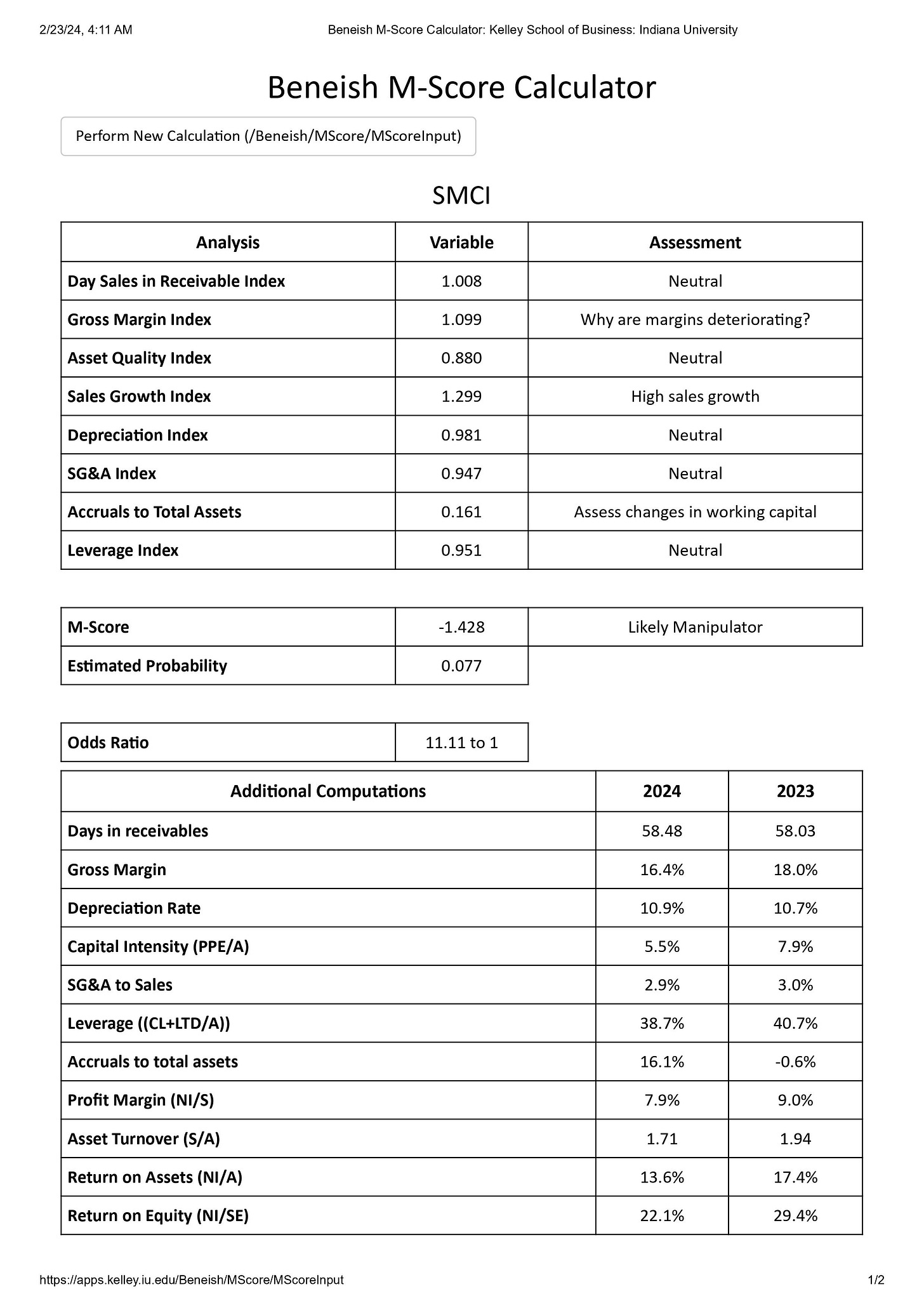

As one would expect, it kinda stirred the pot on X and got quite a lot of engagement. One user asked me to run it for SMCI, NVDA’s partner in crime, not just figuratively. So, I ran the numbers for SMCI through the calculator, and here is the result.

Essentially, the largest enablers of AI and two of the hottest stocks are most likely cooking their books. Now, let’s look at the process I use before diving into researching a company.

Apart from the Beneish M-Score, there is another score called the Altman Z-score. The first step is to apply the Beneish M-Score test, and if it passes that, apply the Altman Z-Score test. If it fails the Beneish M-Score, there is no point in applying the Altman Z-Score. If a company fails either, walk away, there are better things to do in life for us retail investors.

Here are the calculators, available for free:

Beneish M-Score: https://apps.kelley.iu.edu/Beneish/MScore/MScoreInput

Altman Z-score: https://www.creditguru.com/index.php/bankruptcy-and-insolvency/altman-z-score-insolvency-predictor

Initially, I was not intending to share the test results on X, but you know how some of the kids are there. Some of them got under my skin and I just posted it to get rid of them. And the whole thing just blew up.

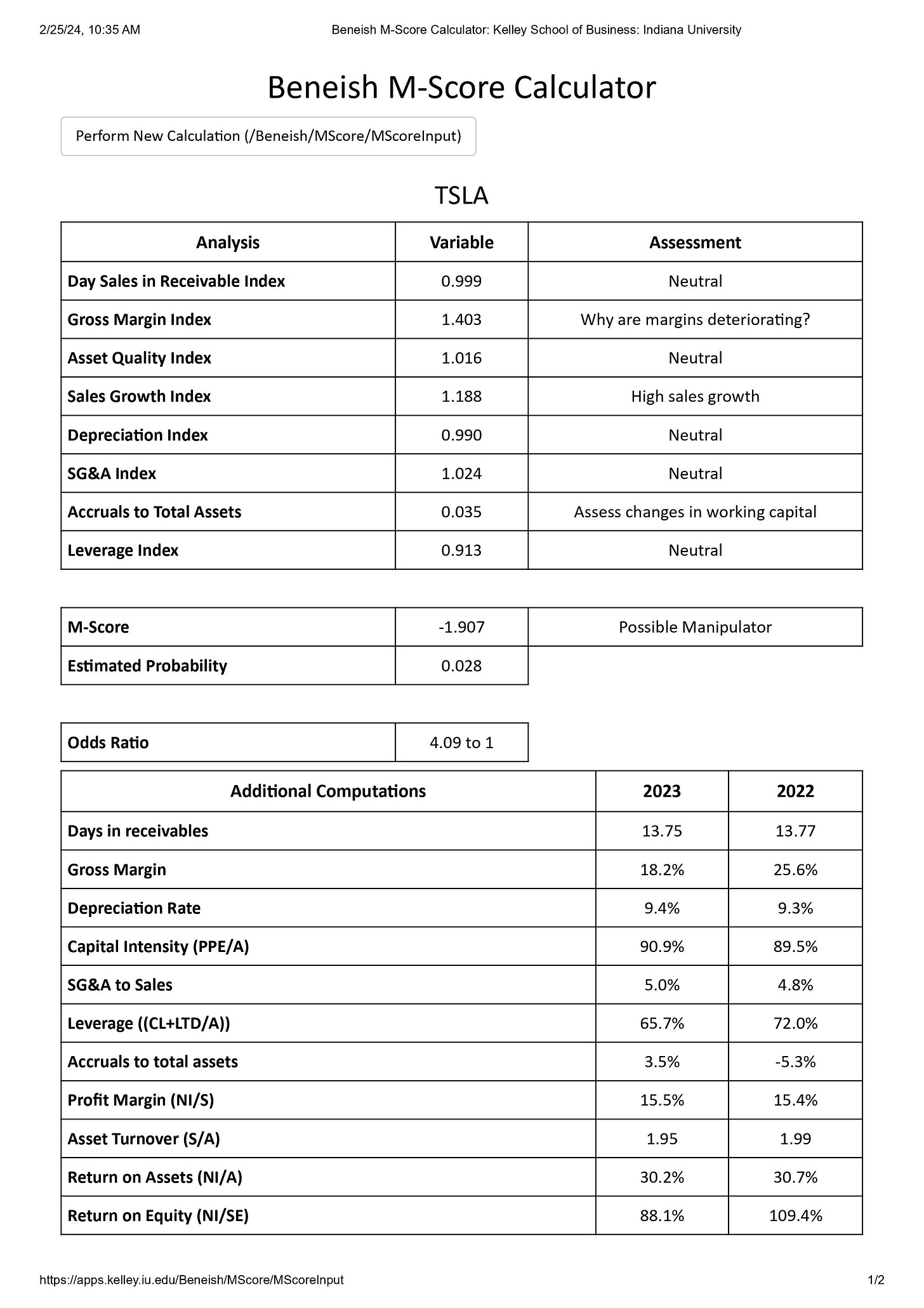

Since I had nothing better to do over the weekend, I started to apply the Beneish M-Score test on a whole bunch of high fliers. Guess what? TSLA got flagged as a “Possible Manipulator”. Now imagine, posting on Elon’s platform and calling him a fraud for manipulating TSLA’s earnings. I am still laughing at the irony of that. Here is the result of the test.

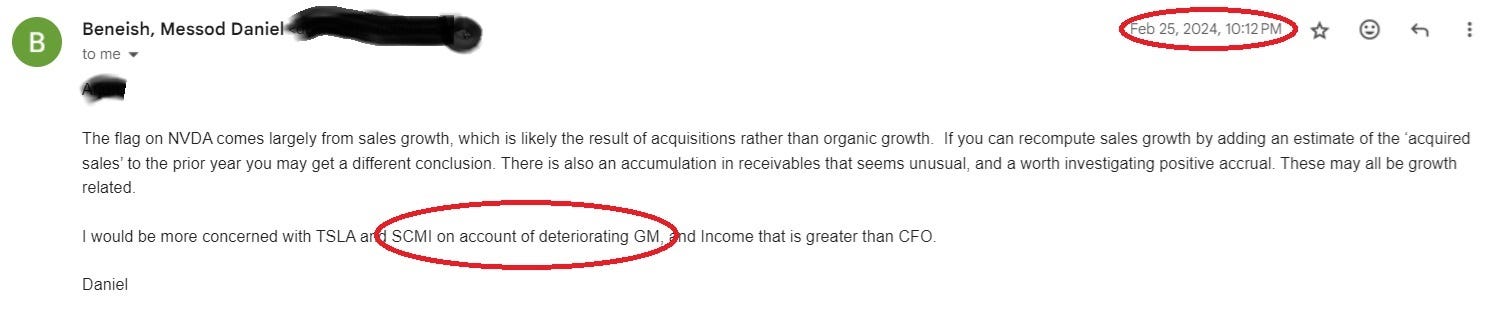

Obviously, going after such storied names on a public platform does draw public scrutiny. As a responsible global citizen, I emailed Dr. Beneish with my findings and requested him to provide his thoughts and feedback. Let’s see what he has to say.

While my findings are still propagating on X, I got a wonderful surprise. A retired fund manager shared another fraud detection tool called the Sloan F-Score (https://politicalcalculations.blogspot.com/2012/01/using-f-score-to-detect-accounting.html#.W45Dj-hKjIU). Interestingly, the F-Score confirms the findings of the Beneish M-Score. I have not researched the F-Score yet, but I am sharing it as it is noteworthy.

The next one on my radar is ANF (Abercrombie & Fitch). It reports on March 6. ANF has already failed the Beneish M-Score for previous financial years. I am just waiting for the latest data to confirm.

Long story short, most of us are not forensic accountants. Experts have built fraud detection tools for us. If the tools say “FRAUD”, just ignore the stock and move on. And yes, don’t short it, as you never know when reality will catch up.

Have enough stock of popcorn ready and a lot of peanuts. The time for throwing peanuts from the peanut gallery and enjoying the show with an abundance of popcorn is coming.

Update

I had written to Dr. Beneish asking for his feedback. Here is his response.

Thanks for introducing to the Beneish M-score. Running my portfolio companies through it right away.